What to Review Before Creating an Offshore Trust Account

What to Review Before Creating an Offshore Trust Account

Blog Article

Discover the Benefits of Using an Offshore Trust for Your Financial Safety

If you're discovering means to reinforce your monetary safety and security, an offshore Trust may be worth considering. These structures provide unique advantages, from shielding your properties against financial institutions to supplying tax benefits. What else could an overseas Trust do for you?

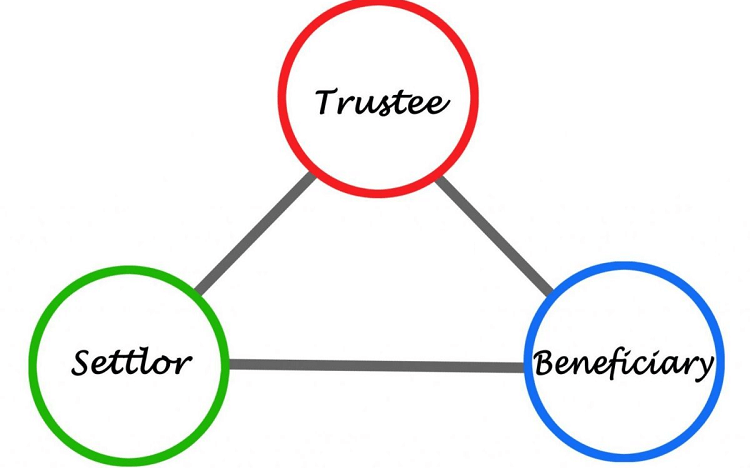

Recognizing Offshore Trusts: What They Are and Exactly How They Work

Offshore trusts are effective economic devices that can aid you protect your properties and attain your estate preparing goals. Fundamentally, an offshore Trust is a legal arrangement where you move your properties to a trust situated outside your home nation. This setup offers numerous advantages, including privacy, flexibility, and prospective tax benefits.

In essence, understanding how overseas trust funds work can equip you to make educated monetary choices, ensuring your possessions are managed and distributed according to your wishes, no matter where you remain in the globe.

Property Defense: Protecting Your Riches From Creditors

When it comes to safeguarding your riches from financial institutions, offshore trusts supply robust legal approaches - offshore trust. They can also supply you with important privacy and privacy advantages, ensuring your monetary information remains safe. By recognizing these benefits, you can better protect your possessions versus prospective hazards

Legal Security Strategies

While building wide range is a considerable achievement, protecting it from possible financial institutions is just as essential. An overseas Trust can be an effective lawful security strategy. By putting your possessions in such a trust, you produce a barrier against financial institutions seeking to assert them. This structure usually drops outside the territory of your home nation, which includes an added layer of security.

You can also choose a trustee you Trust, that will handle the possessions according to your dreams, making it harder for creditors to access them. Additionally, overseas depends on can aid you preserve control over your wide range while ensuring it's guarded from lawful activities. This proactive approach to property protection can offer you assurance as you build your financial future.

Personal Privacy and Discretion Conveniences

Among the essential benefits of developing an offshore Trust is the enhanced privacy it supplies. With an offshore Trust, your monetary events continue to be confidential, offering a layer of security against spying eyes. This implies that your properties aren't conveniently available to lenders or legal entities seeking to claim them. By maintaining your wide range in an offshore jurisdiction, you're additionally lowering the threat of public direct exposure to your economic situation.

In addition, many offshore jurisdictions have stringent regulations that secure the confidentiality of Trust recipients. This can aid you keep control over your possessions without attracting undesirable attention. Eventually, utilizing an offshore Trust permits you to appreciate your riches with peace of mind, recognizing that your financial personal privacy is well-guarded.

Tax Obligation Performance: Minimizing Tax Liabilities Legally

As you check out offshore depends on, you'll uncover a powerful tool for legitimately reducing tax obligation responsibilities. These trusts can assist you benefit from beneficial tax obligation jurisdictions, enabling you to safeguard your riches while decreasing your overall tax obligation concern. By putting your assets in an offshore Trust, you're not simply securing your financial future; you're likewise purposefully placing on your own to benefit from reduced tax rates and prospective exceptions.

Furthermore, overseas counts on can provide versatility concerning earnings circulation, permitting you to pick when and how much to take out, which can even more optimize your tax obligation situation. This means you can handle your income in such a way that straightens with your monetary goals, decreasing tax obligations while optimizing returns.

Basically, an offshore Trust uses a legit avenue for boosting your tax performance, aiding you maintain more of your hard-earned cash while making certain conformity with legal demands.

Privacy and Discretion: Maintaining Your Financial Matters Discreet

When you establish an overseas Trust, you gain a considerable layer of personal privacy that safeguards your financial matters from public analysis. This privacy is crucial in today's world, where financial details can quickly end up being public because of legal process or media exposure. With an offshore Trust, your assets are held in a territory with strict discretion laws, guaranteeing that your monetary events stay discreet.

You manage the Trust, which indicates you choose who knows regarding it and exactly how much they know. Inevitably, an offshore Trust can be an effective tool for those who value discretion in managing their financial safety and personal privacy.

Estate Preparation: Ensuring a Smooth Transfer of Riches

An offshore Trust not just improves your privacy however also plays an essential duty in estate preparation, ensuring a smooth transfer of riches to your beneficiaries. By placing your assets in an offshore Trust, you shield them from prospective probate hold-ups and minimize the danger of household disputes. This framework permits you to specify exactly how and when your heirs get their inheritance, providing you with control over your legacy.

Furthermore, overseas counts on can assist decrease estate tax obligations, preserving more wealth for your liked ones. offshore trust. On the whole, an offshore Trust is a calculated tool that streamlines estate preparation and safeguards your family's financial future.

Investment Flexibility: Broadening Your Financial Opportunities

With an offshore Trust, you obtain accessibility to a variety of investment choices that can improve your portfolio. This adaptability not just enables diversification but can likewise result in substantial tax effectiveness advantages. By tactically picking your assets, you can optimize your monetary chances like never in the past.

Diverse Asset Options

Although lots of financiers concentrate on conventional possessions, offshore counts on offer varied options that can dramatically improve your investment versatility. By utilizing an offshore Trust, you can access a selection of possession classes, including real estate, private equity, and collectibles. Whether you're interested in emerging markets or alternative investments, an offshore Trust can be your gateway to check Clicking Here out these methods.

Tax Performance Advantages

Investing via an offshore Trust not just broadens your possession choices but additionally boosts your tax obligation effectiveness. These trust funds commonly operate in jurisdictions with beneficial tax legislations, allowing you to lessen tax obligation liabilities lawfully. By tactically placing your financial investments in an offshore Trust, you can postpone tax obligations on resources gains, income, and sometimes also inheritance tax, depending on the laws of the Trust's place.

This flexibility lets you handle your investments without the hefty tax obligation burden you could face domestically. And also, you can benefit from one-of-a-kind investment chances that might not be readily available in your house country. Inevitably, an offshore Trust can be a clever move for optimizing your financial approach while keeping even more of your hard-earned cash benefiting you.

Choosing the Right Territory: Trick Factors To Consider for Offshore Trust Funds

When selecting the right jurisdiction for your overseas Trust, comprehending the lawful and tax implications is critical. Different nations have varying guidelines, tax advantages, and personal privacy legislations that can affect your Trust's efficiency. You'll want to take into consideration territories understood for their security, such as the Cayman Islands, Singapore, or Switzerland.

Examine just how her comment is here each place handles asset protection, as some territories offer more powerful safeguards versus lenders. Additionally, look right into the convenience of establishing up and maintaining your Trust-- some places have simpler procedures and reduced management costs.

Eventually, selecting the ideal jurisdiction can substantially enhance your Trust's advantages, giving the financial security you look for. Take your time, do your research study, and get in touch with experts to make a notified choice.

Regularly Asked Concerns

Can I Set up an Offshore Trust From Another Location?

Yes, you can establish up an overseas Trust remotely. Several territories allow on the internet applications and assessments with regional professionals. Simply make sure you recognize the lawful needs and pick a reliable company to lead you.

What Are the Costs Associated With Developing an Offshore Trust?

When developing an overseas Trust, you'll encounter expenses like configuration charges, yearly upkeep fees, and lawful expenses. It's necessary to budget and comprehend these costs prior to continuing to assure it aligns with your economic objectives.

How Do I Choose a Trustee for My Offshore Trust?

To choose a trustee for your offshore Trust, consider their experience, credibility, and understanding of your needs. You'll desire a person trustworthy, dependable, and well-informed concerning worldwide regulations to ensure your assets are well handled.

Are Offshore Trusts Managed by International Laws?

Yes, offshore trust funds great site are subject to global regulations, however laws vary by territory. You'll need to research particular regulations in the Trust's place to ensure compliance and shield your assets effectively.

Can I Change the Terms of My Offshore Trust Later?

Yes, you can alter the regards to your offshore Trust later, provided you comply with the standards embeded in the Trust arrangement. Just consult your lawful advisor to assure you're making the ideal adjustments.

Final thought

Including an overseas Trust right into your economic strategy can substantially improve your wide range protection and monitoring. By securing your properties, reducing tax obligations, and ensuring privacy, you're setting on your own up for a secure financial future. And also, with structured estate planning and increased investment chances, you're not simply safeguarding your wide range; you're proactively expanding it. Take the time to discover your alternatives and select the best territory to take full advantage of the advantages of your offshore Trust.

Offshore counts on are powerful economic devices that can assist you protect your possessions and achieve your estate preparing goals. Basically, an overseas Trust is a lawful plan where you move your properties to a depend on located outside your home country. By putting your assets in an overseas Trust, you're not just securing your financial future; you're likewise strategically positioning on your own to benefit from lower tax prices and prospective exemptions.

With an offshore Trust, your properties are held in a jurisdiction with stringent confidentiality regulations, making certain that your economic affairs continue to be very discreet.

By purposefully positioning your financial investments in an offshore Trust, you can delay tax obligations on funding gains, revenue, and often even estate taxes, depending on the policies of the Trust's place.

Report this page